Chase Bank Information

Introduction

Chase Bank is one of the top banks in the United States, offering a variety of financial services for individuals and businesses. In addition to banking, Chase offers credit cards, mortgages, investments, auto loans, and other products. With thousands of branches across the country, Chase makes it easy to access its services wherever you are located. In this article, we will explore the details of Chase Bank, including its products and services, number of branches, and rates for high-yield savings accounts.

Products and Services

Chase offers a wide range of financial products and services to meet the needs of customers. The following are some of the products offered by Chase:

1) Checking accounts

This account allows users to deposit and withdraw money, as well as make payments using their debit cards.

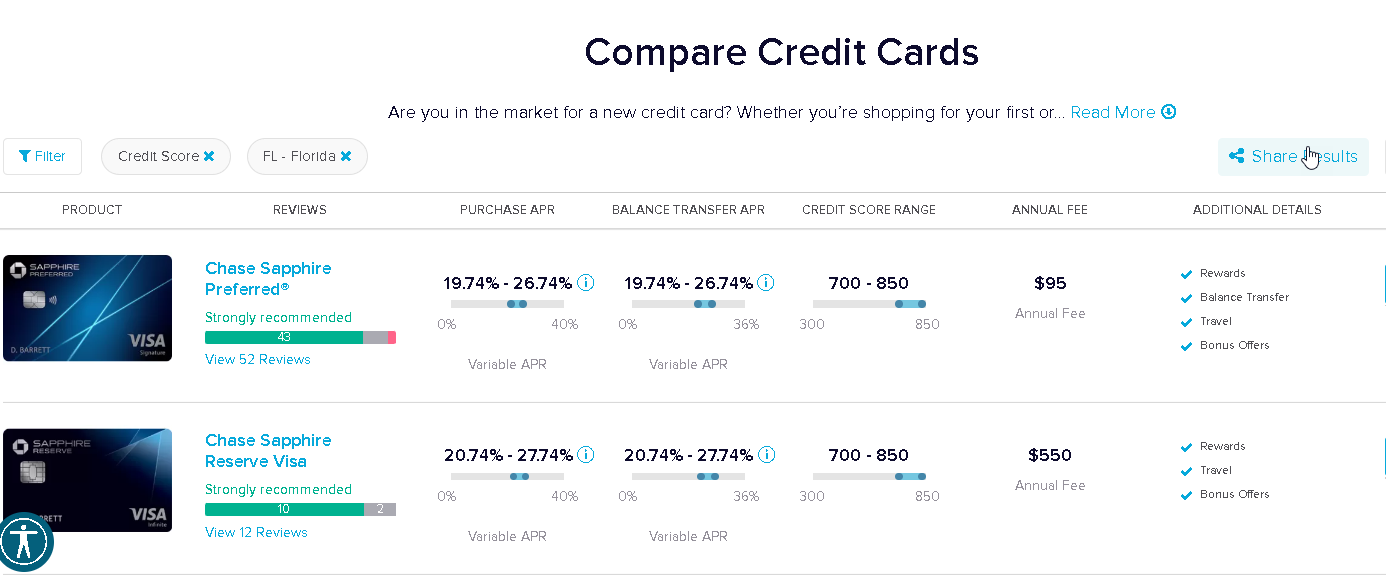

2) Credit Cards

Chase offers several types of credit cards, including rewards cards, cash-back cards, and signature cards.

3) Loans

Whether you need a mortgage or an auto loan, Chase can provide competitive rates and terms.

4) Investments

Chase offers several types of investments, including stocks, mutual funds, and ETFs.

5) Online Banking

Customers can access their accounts online and use tools to manage finances, pay bills and transfer money.

6) Wealth Management

Chase offers wealth management services to help customers manage and invest their money.

Number of Branches

Chase has over 4,700 branches across the United States. Customers can access their accounts at any of these locations and get assistance with banking, credit cards, mortgages, and other services. The bank also has over 16,000 ATMs located around the country.

Rates for High Yield Savings Accounts

Chase Bank offers competitive interest rates for high-yield savings accounts. Customers can earn up to 0.10% APY on their balance, depending on the amount deposited. In addition, there are no monthly service charges or minimum balance requirements associated with these accounts.

The benefits of a Chase Bank.

There are many benefits to banking with Chase. Here are some of the advantages of choosing Chase Bank for your financial needs:

1) Convenience

When you bank with Chase, you can access your accounts online or at any of the thousands of branches across the United States.

2) Competitive Rates

Chase offers competitive interest rates on their banking and investment products, making them a great choice for those who are looking to maximize their returns.

3) Wide Range of Products and Services

Whether you need a checking account, credit card, loan, or investment, Chase has something to meet your needs.

4) Customer Service

Chase Bank provides excellent customer service with knowledgeable and friendly staff who are always willing to help.

5) Security

Chase Bank provides top-notch security measures to protect your money and information.

6) Flexibility

Chase Bank offers flexible terms and convenient features to make banking easy.

Those are just some of the many benefits that come with banking at Chase.

What are the factors to consider before banking with Chase?

Before you decide to bank with Chase, there are some factors you should consider. Here are seven things to keep in mind:

1) Fees

Be sure to read through the fees associated with any account or loan that you may open. While Chase Bank offers competitive rates, they do charge monthly service fees or other fees depending on the product.

2) Accessibility

Look at how easy it is to access your accounts and whether you will be able to do so from anywhere in the United States.

3) Reputation

Do your research on Chase Bank’s reputation for customer service, security measures, and overall satisfaction.

4) Financial Stability

Make sure that Chase Bank is financially stable and will not be affected by any market or industry changes.

5) Investment Options

Research the different types of investments offered by Chase and how they compare to other banks.

6) Technology

Look into what technology Chase has in place for online banking and investing.

7) Rewards

Check out Chase Bank’s rewards programs and bonus offers to see if they are worth taking advantage of.

These factors should be taken into consideration when choosing a bank, especially if you are looking for the best option for your financial needs. With competitive rates, convenient access, and excellent customer service, Chase Bank is a great choice for those looking to manage their money.

Risks for Banking with Chase

Despite the many benefits of banking with Chase, there are some risks associated with their services. Here are some of the potential risks you should be aware of:

1) Market Risk

When investing in stocks and other securities, customers may experience losses due to market volatility or other factors.

2) Interest Rate Risk

Changes in the interest rate can affect investments, especially those tied to fixed-income securities.

3) Credit Risk

Customers may end up with losses if the bank fails to make good on its obligations or is unable to repay its debt.

4) Liquidity Risk

If customers are unable to cash out their investments or access their funds, they may be left with losses.

5) Operational Risk

Customers may face financial losses due to operational mistakes or errors by Chase Bank or its employees.

6) Cybersecurity Risk

Chase Bank’s online systems may be vulnerable to malicious actors, putting customers at risk of financial losses.

7) Regulatory Risk

Changes in the regulatory environment may have a negative effect on customers’ investments.

It is important to keep these risks in mind when considering banking with Chase. Although they offer many benefits, it is important to be aware of the potential risks associated with their products and services.

Conclusion.

In conclusion, Chase Bank is an excellent choice for those looking to manage their money. With competitive rates, a wide range of products and services, customer service, security, flexibility, and rewards programs, Chase Bank offers many benefits that make it a great option. However, there are some risks associated with banking at Chase Bank which should be taken into consideration before making the decision to invest. With the right research and informed decision-making, Chase Bank can be a great choice for managing your finances.