What Are The Best Business-Friendly Banks In The USA

No matter how big or small, every company or professional organization requires a beneficial and systematic checking account and also a saving account. Business credit cards and the required accounts are designed to keep your business earnings safe and help you to build a desirable financial record of your enterprise/organization/business. A business account under the right bank is critical for proper tax reporting, bookkeeping, and various legal reasons. With the right business-friendly bank, all your business operations will be handled effectively and securely be it making payments to your workers/staff/employees or receiving deposits from customers/clients.

Now the natural query of any business owner must be – which bank will be the right one for my particular business? To make it easier for you, the best banks operating in the USA that are considered business-friendly, reliable, and efficient have been discussed next. So, do read on to know them better.

TOP BUSINESS-FRIENDLY BANKS OF AMERICA

1. CHASE BANK

The business checking account fee for this one is $15 and you have to keep a minimum balance of $2000 (might be subjected to fees). Both credit cards and loans are available from this account.

Highlights

* +15,500 ATM locations and +3500 branch locations

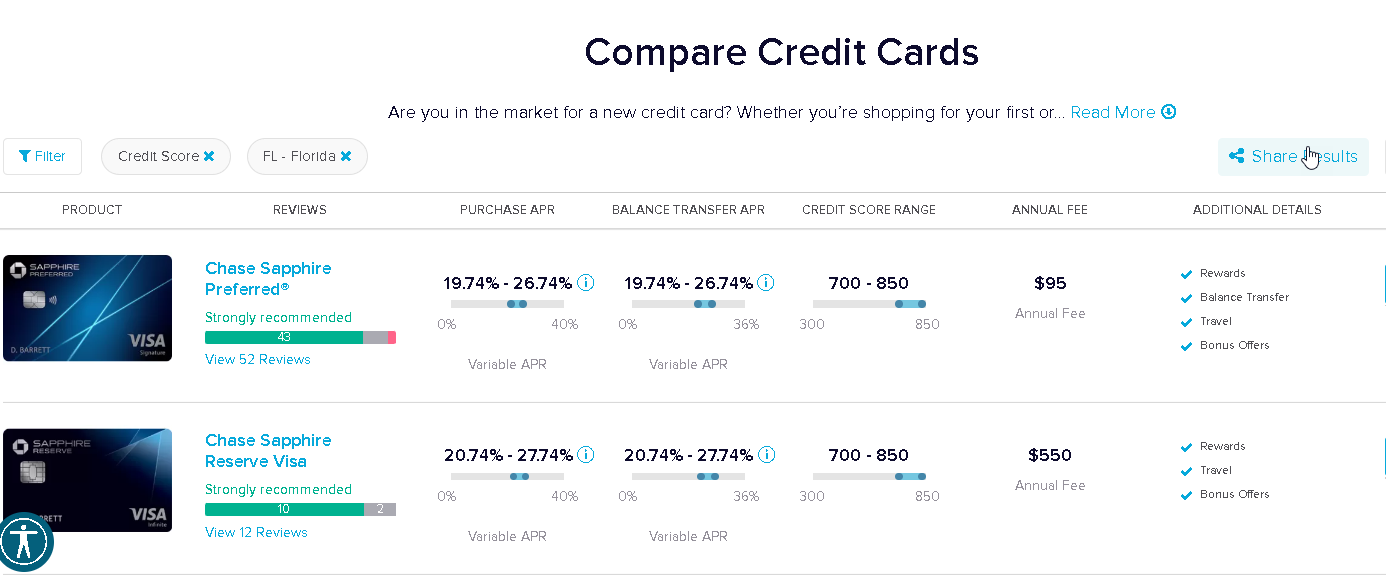

* Provides leading business credit cards in the market with high-value rewards

* User-friendly mobile banking app

* Many different tiers of business accounts

* Great bonuses for new accounts

* Can be linked with personal accounts

Drawbacks

* Maintaining the minimum balance is necessary to escape the monthly maintenance fees

* Only 100 free transactions every month

Considered a great overall bank, this one will be ideal for small businesses that do not require to do more than 200 transactions each month. Chase Bank is also great for business owners who prefer access to brick-and-mortar banks for the in-person services they can provide. Organizations that prefer to use business credit cards to make business purchases will benefit from choosing this bank.

2. WELLS FARGO

The checking account for businesses for this one is $25 and you have to keep an average balance of $10,000 for this checking account (business) if you want the fee to be waived. For checking, credit, and savings in combined balances, the average balance needs to be $15,000.

Highlights

* +12,000 ATM locations and +4,900 branch locations

* Monthly free 250 transactions

* Cashier’s checks, stop payments, and other business services are not subjected to fees

* This bank has the most number of branches in the USA

* Provides HR, payroll, and business tax services

* The best bank for loans (small businesses especially)

Drawbacks

* All business accounts are subjected to monthly fees

* High minimum balance to waive fees

This bank is the 3rd largest bank operating in America and is considered the best-suited bank for business owners who deal with a high number of transactions every month and desire no to low banking fees. With Wells Fargo, business owners can also be benefitted from fee-free ATM withdrawals.

3. BANK OF AMERICA

The checking account fee for businesses for this one is $14 to $29.95 (for Business Advantage). To waive fees, you have to maintain a minimum balance of $3000.

Highlights

* +16,000 ATM locations and +4300 branch locations

* Free transactions are 200 in total monthly

* Several methods to take the advantage of monthly fee waived are provided

* Provides fee-free cash deposits of $7500 (Cash deposit fee per $100 is $0.30)

Drawbacks

* Bank of America is not the best options for businesses involved with cash deposits of high volume

* Online customer service sometimes does not reciprocate as expected

One of the main reasons behind this bank being a favorite of most business owners is its low transaction fee ($0.45). Bank of America is known for its introductory offers added for the checking accounts for businesses. Businesses can avail of business loans and credit cards.

4. CAPITAL ONE

The checking account (business) fee for this one is $15 and you have to keep $2000 as a minimum balance to waive this fee. The major benefit that this bank can provide businesses is the unlimited transactions every month advantage that too with no minimum balance for this account.

Highlights

* There are +39,000 free ATMs (Allpoint) access across the globe

* Provides competitive money market accounts created for handling business savings

* Provides checking accounts for businesses with zero minimum balance advantage

* Friendly and helpful online services

Drawbacks

* It has 700 locations across the world and finding a brick-and-mortar outlet can be a bit difficult

* The limitation for fee-free cash deposit is $5000 monthly

With the unlimited transaction feature, businesses involved with massive online business transactions can save on bank transaction fees. This business banking solution offers advantageous loan options and many different business credit cards (including 5 credit cards designed for small businesses only).

5. AXOS BANK

The fee for a business checking account with this bank is $0 and it also provides the advantage of no minimum balance.

Highlights

* +91,000 ATM locations across America and a total of 3 branches located in Ohio (Columbus), Nevada (Las Vegas), and California (San Diego)

* 200 free transactions for every month

* Free first 50 checks

* No monthly service charges

* Your balance will be looked over by federal insurance (FDIC-insured deposits)

* User-friendly online portal with cutting-edge online banking tools

* From lines of credit to equipment financing, this bank provides many lending options

* With checking accounts of this bank, businesses can enjoy free ATM reimbursement and no unreasonable surcharges

Drawbacks

* You have to maintain a $5000 average daily balance or else you have to pay a monthly fee of $10.

* No brick-and-mortar branch

A business owner looking for a secured and effective online-only checking account for their particular business can depend on Axos Bank. This oldest online bank in America allows business owners access to their checking accounts for business from any ATM outlet in America for free.

TO CONCLUDE

Now that you have gone through the whole list of the best business-friendly banks operating across America, you can see that each one comes with its own unique features, pros, and cons. While Chase Bank is considered the best overall bank, Capital One is considered the best bank for unlimited transactions and Axos is the best when it comes to e-commerce. So, before you pick one from the list provided above, check out each one in detail to ensure the one you picked is indeed best suited for your business and for you as the business owner as well.